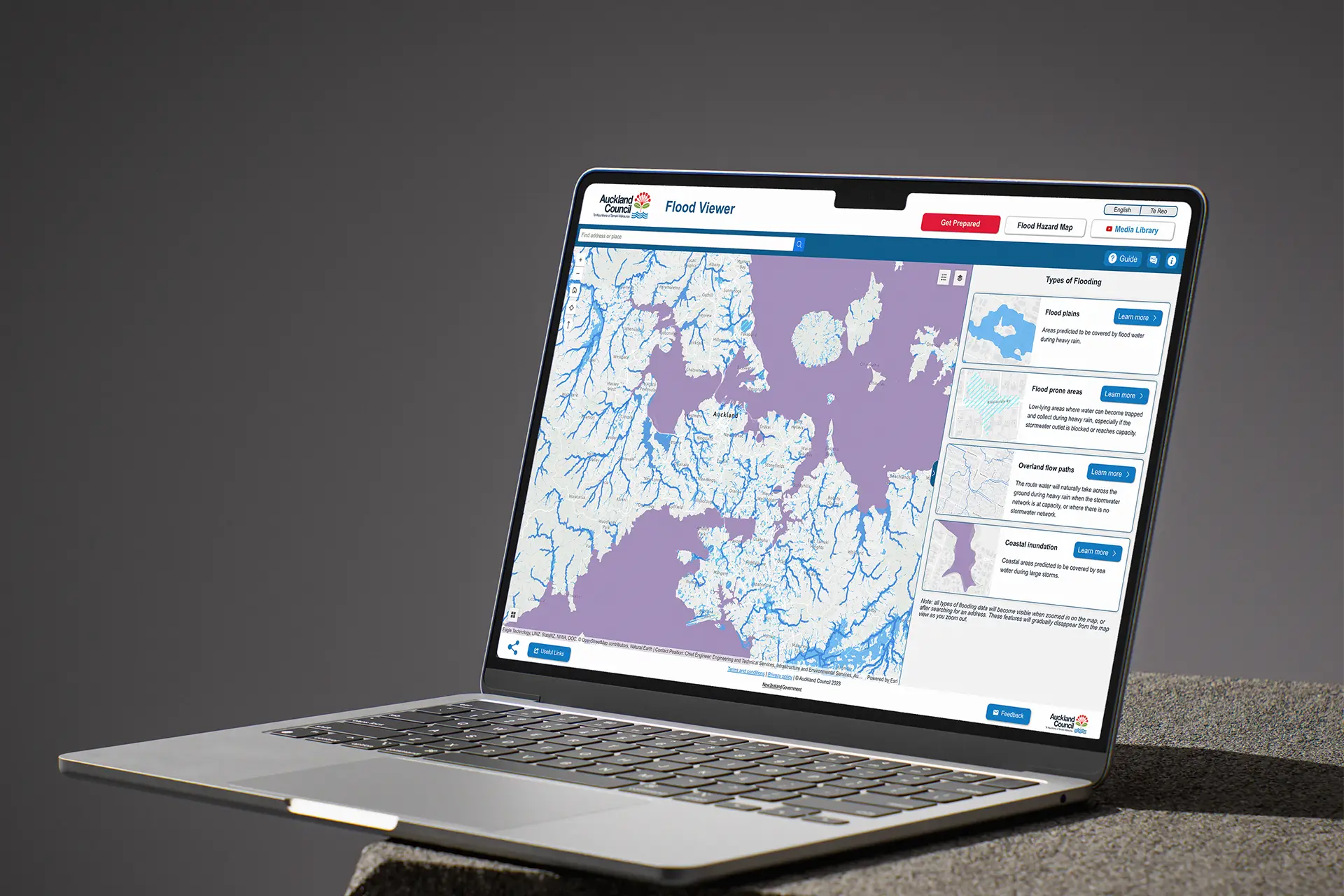

Auckland Council’s new online flood zone tool has been hailed as a step forward for transparency by some — but it’s also stirring anxiety among property owners. The tool, designed to help users check flood-risk properties by address, identifies areas at risk of flooding from heavy rain, streams, or coastal erosion.

Background

The initiative stems from lessons learned after the devastating 2023 floods, which destroyed homes and cost lives. “Check for flood risks before you buy or build,” the Council warns on its website — sound advice for prospective buyers, but sobering news for long-term homeowners discovering, sometimes for the first time, that their property now sits within a flood zone.

A New Layer of Disclosure in Real Estate

From a legal standpoint, the tool introduces new challenges in property conveyancing and disclosure. Sellers must ensure that potential buyers are fully informed about any flood risks revealed in a Land Information Memorandum (LIM). Failure to disclose such information could expose vendors and agents to claims of misrepresentation, even if the property’s flood status was only recently updated.

Buyers, too, must act carefully. A conveyancing lawyer can review the LIM report, interpret technical flood data, and explain what it means for future insurability, mortgage eligibility, and resale value. As the new tool is integrated into Auckland Council’s LIM system, its findings will carry significant legal weight in property transactions — meaning a casual glance at an online map is not enough.

When Your Home Becomes a Flood Zone

For some owners, updated LIMs have come as an unpleasant shock. The report noted that homeowners who have lived in their houses for 25 years may suddenly find a “blue flood-zone lake” drawn around their property, deterring buyers and insurers alike. Insurers may refuse coverage, and banks may become hesitant to lend against affected properties.

Challenging a flood-zone classification can be complex, lengthy, and expensive. Property owners face an uphill battle convincing the Council to reverse its assessment — with no guarantee of success. Meanwhile, the property’s market value and liquidity can decline sharply.

Planning, Accountability, and Infrastructure

The new flood-mapping initiative also raises questions of accountability. Some affected homeowners argue that Council policies have contributed to the very risks being highlighted. Infill developments, where multiple townhouses replace a single dwelling, have intensified pressure on Auckland’s ageing stormwater systems. Without adequate holding tanks, permeable surfaces, or drainage upgrades, rainfall has fewer places to go — often ending up in neighbouring sections or overburdened waterways.

The Council’s own Plan Change 120 proposes to accommodate up to two million new homes in coming decades. As public consultation on this plan unfolds, it remains critical that flood risk mitigation keeps pace with urban intensification.

The Legal Bottom Line for Buyers and Sellers

For buyers, the flood zone tool is a valuable due-diligence aid — but it also underscores the need for professional legal advice before purchase. A conveyancing lawyer can help interpret flood-risk data, negotiate appropriate contract conditions, and ensure that all disclosure obligations are met.

Wynyard Wood provides expert advice in real estate and conveyancing law, helping buyers and sellers navigate complex property issues such as flood-zone disclosures and LIM updates.

Related Articles:

Related Services:

The legal rules surrounding property are constantly evolving. See here for the many ways that we can help.

Read More

If you are involved with a building project and need legal assistance, we can help you objectively review your circumstances, and what next steps are most appropriate for your situation.

Read More

Offering a wealth of experience in insurance law, we are available to assist you or your clients with any insurance issues or problems that could benefit from legal advice.